how much taxes does illinois take out of paycheck

Personal income tax in Illinois is a flat 495. There also may be a documentary fee of 166 dollars at some dealerships.

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

There are two state taxes to be aware of in Illinois.

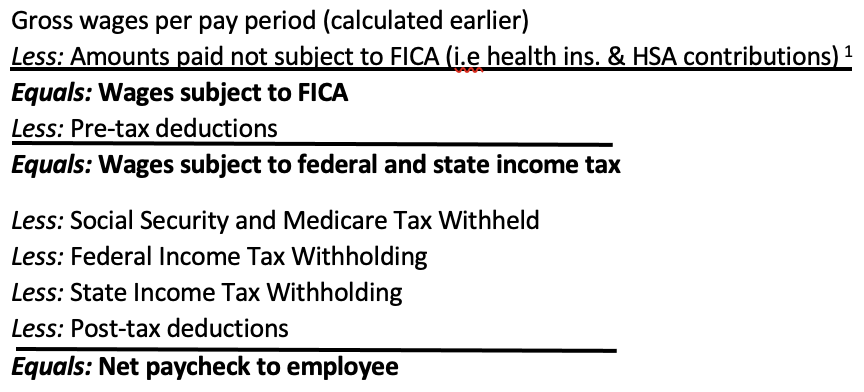

. Personal income tax and unemployment tax. Generally the rate for withholding Illinois Income Tax is 495 percent. That means the money comes out of your paycheck before income taxes do.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois. Illinois collects a 725 state sales tax rate on the purchase of all vehicles. For wages and other compensation subtract any exemptions from the wages paid and multiply the result by 495 percent.

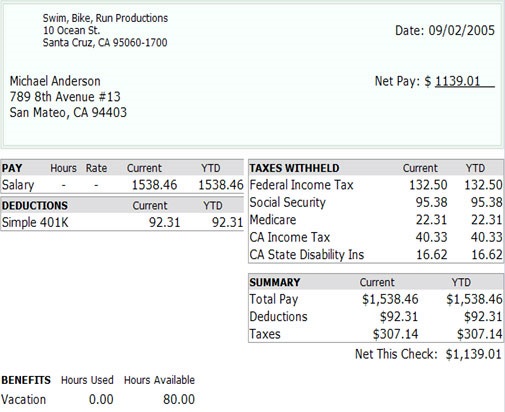

The average tax rate for taxpayers who earn over 1000000 is 331 percent. These are contributions that you make before any taxes are withheld from your paycheck. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator. How much taxes does illinois take out of paycheck Sunday February 27 2022 Edit Each pay period 62 of your paycheck goes to your share of Social Security taxes and 145 goes to. Median household income in Illinois.

The wage base is 12960 for 2021 and rates range from 0725 to 7625. Calculating paychecks and need some help. How much is payroll tax in Illinois.

No an employer cannot deduct money from your pay for cash or inventory shortages or damages to the employers equipment or property unless you sign an express written agreement allowing the deductions AT THE TIME the deduction is made. Just enter in the required info below such as wage and W-4 information and our tool will perform the necessary calculations. However where a deduction is to continue over a period of time.

If youre a new employer your rate is 353. If youre married filing jointly youll see the 09 percent taken out of your paycheck if you earn 250000 or more. In addition to state and county tax the City of Chicago has a 125 sales tax.

See Section 300730 and Section 300820. For the employee above with 1500 in weekly pay the calculation is 1500 x. Stop fussing over confusing calculations or tax rulesthis article will help you understand what you need to do to process Illinois payroll.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. Employers can find the exact amount. Payroll taxes in Illinois.

How do I calculate how much tax is taken out of my paycheck. Some accounts like a 401k FSA or HSA allow you to make pre-tax contributions. Switch to Illinois hourly calculator.

There is also between a 025 and 075 when it comes to county tax. The Illinois Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings. For those who make between 10000 and 20000 the average total tax rate is 04 percent.

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Gov Pritzker Can T Take Credit For Illinois Improved Budget Projections When It S The Feds That Bailed The State Out Madison St Clair Record Why Illinois Is In Trouble 109 881 Public Employees With 100 000 Paychecks Cost Taxpayers 14b. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits.

Generally the rate for withholding Illinois Income Tax is 495 percent. Personal Income Tax in Illinois. Newly registered businesses must register with IDES within 30 days of starting up.

How much tax is taken out of a 500 check. How much is 60000 a year after taxes in Illinois. Unemployment Insurance UI supplies funding for the Illinois Department of Employment Security IDES which pays benefits to the unemployed.

There is an Additional Medicare Tax of 09 percent withheld from employees paychecks if they earn more than 200000 annually regardless of their income tax filing status or wages earned at another job. The average tax rate for those in the lowest income tax bracket is 106 percent higher than each group between 10000 and 40000. Illinois Paycheck Quick Facts.

Unlike Social Security Medicare taxes are levied on all incomes. So while making those contributions will decrease your. Use ADPs Illinois Paycheck Calculator to calculate net take home pay for either hourly or salary employment.

Illinois income tax rate.

How Many Taxes Are Taken From 560 A Week From 28 Hours Quora

Why Illinois Is In Trouble 109 881 Public Employees With 100 000 Paychecks Cost Taxpayers 14b

Here S How Much Money You Take Home From A 75 000 Salary

Unilife How Much Tax Is Taken Out Of A 600 Paycheck Calculator Without

Understanding Your Pay Statement Office Of Human Resources

Unilife How Much Tax Is Taken Out Of A 600 Paycheck Calculator Without

Unilife How Much Tax Is Taken Out Of A 600 Paycheck Calculator Without

How Much Money You Actually Take Home From A 75 000 Salary Under Trump S New Tax Law Depending On Where You Live Business Insider India

Paycheck Calculator Take Home Pay Calculator

2022 Federal State Payroll Tax Rates For Employers

Different Types Of Payroll Deductions Gusto

How Much Should I Set Aside For Taxes 1099

Taxes 5 1 Taxes And Your Paycheck Payroll Taxes Based On Earnings Paid To Government By You And Employer Income Taxes You Pay On Income You Receive Ppt Download

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

Illinois Paycheck Calculator Smartasset

Understanding Your Paycheck Taxes Withholdings More Supermoney

What You Need To Know About Hiring Workers Calculating A Paycheck Ilsoyadvisor

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest